Understanding Singapore’s Pension System: A Guide for Expats

Known as the Central Provident Fund (CPF) scheme, Singapore’s pension system is one of the best in the world and ranked first in Asia in the 2023 Mercer CFA Institute Global Pension Index.

Compulsory for both Singapore Citizens and Permanent Residents, the CPF scheme has long divided public opinion, with some loving the social security of the scheme, and others questioning its intention and useability.

Foreigners cannot opt into the CPF scheme, and so must turn to other ways of saving and planning for retirement.

Let’s have a quick look at the CPF scheme to understand how it works, how it benefits Singapore Citizens and Permanent Residents, and what you can do as an expat to plan for your own retirement.

An introduction to CPF

Very simply put, CPF is a forced savings scheme that aims to help Singaporeans support themselves throughout their retirement. Some people liken it to a pension scheme–but the difference lies in the need for you to put a fixed percentage of your monthly salary into your CPF account alongside your employer’s monthly contribution.

Set up in 1955, the CPF is the bedrock of Singapore’s social security system by offering four key forms of support to citizens: retirement, healthcare, housing, and education.

One of the safeguards put in place to help ensure that Singaporeans have savings for different stages of their lives is the four separate accounts of your CPF scheme.

Each of these accounts can be used for different purposes.

-

Ordinary Account (OA): Can be used for housing, insurance, investment, and education.

-

Special Account (SA): Strictly reserved for retirement and investment in retirement-related financial products. This account will be closed when you turn 55.

-

Medisave Account (MA): Can be used to cover healthcare expenses such as hospitalisation, and to pay for medical insurance.

-

Retirement Account (RA)*: Only created when you turn 55, pulling together savings from your OA and SA to provide monthly payouts during retirement.

* The RA is only created when you turn 55 years old, and as its name suggests, exists for your retirement use. There are strict conditions governing the withdrawal of funds from this account, which we will explain in the section below.

Employer and employee contributions

One of the most advantageous things about the CPF scheme is that your employer also contributes a portion of your salary to your CPF accounts–on top of YOUR contribution.

CPF contributions are mandatory for all Singapore Citizens and Permanent Residents who earn more than S$50 a month, except for self-employed persons, who are encouraged to make their own regular CPF contributions to their Medisave account.

The exact amount that your employer has to contribute varies based on your age, your total wage, and whether you’re a Singapore Citizen or Permanent Resident. Permanent Resident rates only differ for the first two years of being a PR and become the same as Singapore Citizen rates from the third year onwards.

It can get a little confusing, but you can calculate the exact amount here using this CPF calculator.

So to illustrate this: If you are a 54-year-old Singapore Citizen who is earning S$5,000 a month, you will need to contribute 20% of your own salary (S$1,000) to your CPF accounts, and your employer adds another 17% of your salary (S$850) into your CPF accounts.

You will take home a monthly salary of S$4,000 per month, while your CPF account gains S$1,850 every month from both employee and employer contributions. Employers will make the contribution to your CPF accounts on both his and your behalf– so you won’t need to do anything on your end except to check that there are no discrepancies in the amount paid into your CPF accounts.

Remember that it is mandatory for your employer to make the CPF contribution by the last day of the calendar month.

If you don’t receive your CPF contributions on time, you should check in with your employer on that and can even lodge a report with the CPF board if no payment is made even after repeated reminders to your employer. Enforcement actions may even be taken if employers fail to pay up.

How can I use the funds in my CPF accounts?

As explained above, the funds in each of the four CPF accounts may be used for very specific needs. To recap:

-

Ordinary Account (OA): Can be used for housing, insurance, investment, and education.

-

Special Account (SA): Strictly reserved for retirement and investment in retirement-related financial products. This account will be closed when you turn 55.

-

Medisave Account (MA): Can be used to cover healthcare expenses such as hospitalisation, and to pay for medical insurance.

-

Retirement Account (RA): Only created when you turn 55, pulling together savings from your OA and SA to provide monthly payouts during retirement.

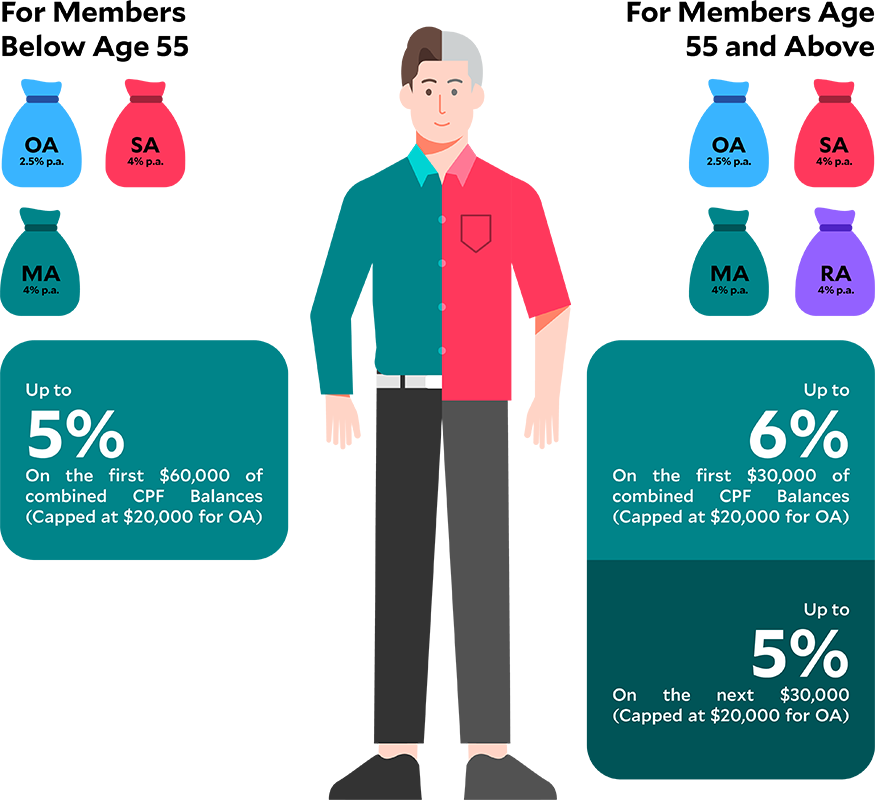

Maximising the power of compounded CPF interest

To motivate Citizens or PRs to save their money in their CPF accounts, the CPF board offers attractive interest rates.

The rates vary according to your age (whether you are below age 55, or 55 and above), which account you’re putting your money into, and how much you’re putting in.

The infographic below summarises the current rates from now till 30 September 2024.

Source: Central Provident Fund Board, Singapore

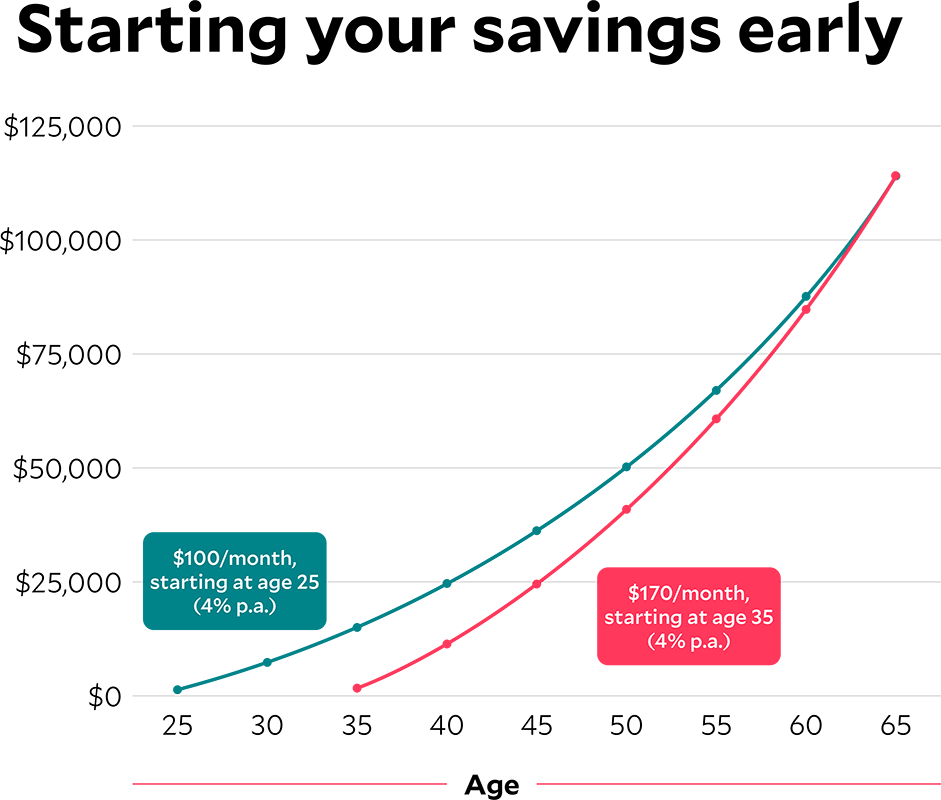

Because the CPF interest rates are so good, it’s wise to maximise your savings with compounded interest earned.

Source: Central Provident Fund Board, Singapore

Using the graph to visualise the power of compounded interest, you’ll see how saving S$100 a month from the age of 25, with an interest rate of 4% per annum, will grow to S$116,000 by the time you hit the retirement age of 65. (Without interest compounding your savings, you would only have managed to save S$48,000 by age 65.)

So simply put: the longer you leave your money in your CPF accounts to grow from the interest rates, the more you will benefit in the long run.

Retiring with CPF monthly withdrawals

One of the main reasons the CPF scheme was set up was to help Singaporeans retire well and responsibly.

As such, there are strict conditions governing the withdrawal of funds from the RA, specifically ensuring a minimum sum of money in the RA which needs to be left in the account (known as the Full Retirement Sum), so that you are able to withdraw your desired payouts every month.

You also get to withdraw money from your RA upon turning 55, after setting aside the FRS amount. There are a whole set of conditions that allow you to withdraw different sums of money, depending on how much savings you have in your OA and SA when you turn 55–read all about it here.

In a nutshell, there are three levels of retirement funds you need to know:

-

Basic Retirement Sum (BRS): the sum which provides your monthly payouts in retirement, which should be sufficient to cover your basic daily living needs.

-

Full Retirement Sum (FRS): the ideal sum of money you need to retire comfortably.

-

Enhanced Retirement Sum (ERS): provides a higher monthly payout if you are able to add more funds to your RA.

The minimum sums for each of these funds will increase with each year, taking into consideration year-on-year inflation, to ensure that you will be able to retire comfortably.

The table below illustrates the stipulated BRS and FRS figures for people turning 55 in 2024:

| Retirement Sum Type | Amount in Retirement Account at Age 55 | Estimated Monthly Payout from Age 65 |

|---|---|---|

| Basic Retirement Sum (BRS) | S$102,900 | S$840 - S$900 |

| Full Retirement Sum (FRS) | S$205,800 | S$1,560 - S$1,670 |

Source: Central Provident Fund Board, Singapore

If you’re unable to meet the minimum BRS amount, you can still withdraw your monthly payouts–just at a lower sum.

Supplementary Retirement Scheme for expats

If you are not intending to become a Singapore Permanent Resident but have plans to retire here, you may consider participating in the Supplementary Retirement Scheme (SRS), which Singapore Citizens, Permanent Residents, and foreigners may all join.

The SRS is a voluntary savings scheme run by the private sector, which will help you save for your retirement, maximising your savings by also providing tax relief.

There is a dollar-for-dollar tax relief for the amount you save in your SRS account, up to a maximum of S$35,700 per year for foreigners. (This is more than double the maximum for locals!)

To ensure that you continue to enjoy the higher foreigner cap, you must declare your foreigner status yearly using this form.

Use the tax savings calculator here to calculate how much tax relief you’ll enjoy when you deposit your money into your SRS.

Your SRS funds can be used to invest in financial products such as bonds, fixed deposits, shares, and unit trusts. The best part is that the returns on your investments made through your SRS are also tax-free!

When you choose to withdraw your funds from the SRS to use in your retirement, only 50% of what you’ve taken out will be taxed. Click here, to find out more about SRS withdrawals.

To open an SRS account, you may approach one of the three Singapore banks below:

Other options for retirement plans for expats

-

Private pension plans are widely available in the form of retirement funds, which you may purchase from insurance companies.

-

Transferring an international pension over to Singapore.

-

Investments.

What do our customers say?

![The Cost of Living in Singapore [2024] The Cost of Living in Singapore [2024]](https://cdn.wisemove.sg/image/blog/1b14e9b503b5517c64f55f4aea2e187e.jpeg)